Business Incentive Programs

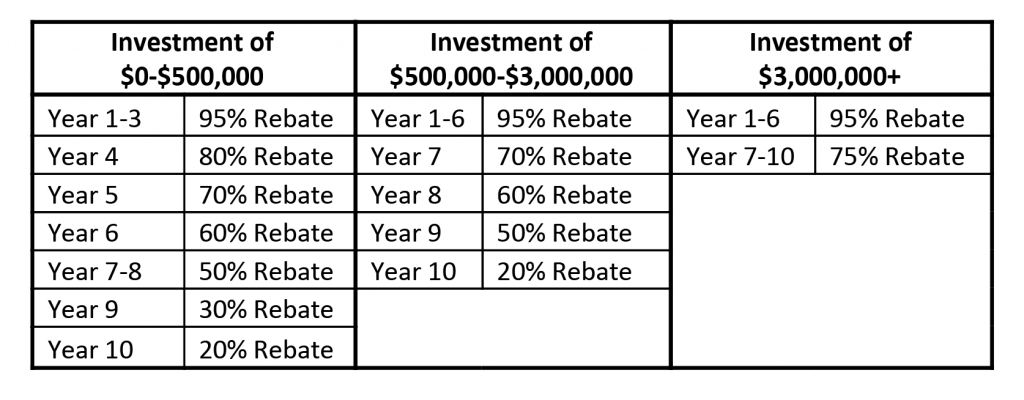

A Neighborhood Revitalization program is in existence which includes the entire county. This program offers property tax rebates for rehabilitation of existing buildings and new construction. The neighborhood revitalization schedule is:

Rural Opportunity Zones (ROZ) are designed to spur economic development in and expand job growth in 77 key counties around the state. The program has two main incentives:

A state income tax exemption for up to five years to individuals who move to a ROZ county from outside the state. Individuals must not have lived in Kansas for the past five years, nor have Kansas source income of more than $10,000 per year over the past five years.

Student loan forgiveness of up to $3,000 per year ($15,000 maximum benefit) for individuals who graduate from an accredited post-secondary institution and move to a ROZ county. The student loan forgiveness portion of the program is a county-state partnership or a business-state partnership. For more information contact Ashley Smith at info@prattkansas.org or 620-672-5501.

Various other business development and business incentives are available in Pratt including access to capital through various revolving loan funds and programs. Contact Kimberly DeClue at info@prattkansas.org or 620-672-5501 for more information about available assistance to grow or start your business.

Pratt County will consider abatement's which may exempt a project from all, or a portion, of ad valor-em taxes due on buildings, land, and improvements. To qualify, companies must be involved creating jobs through manufacturing, conducting research and development, selling goods, or storing goods or commodities which are sold or traded in interstate commerce. Additions to, or expansions of, existing businesses may qualify for a property tax exemption if new jobs are created as a result of such activity. Factors to be considered in awarding an abatement are:

- Amount of capital investment

- Number of employees

- Average employee wages

- A cost benefit analysis examining return on investment for the County

- The State of Kansas offers significant and comprehensive business incentives to encourage the construction and expansion of Kansas businesses and industries.

The PEAK Program targets companies looking to relocate or expand in Kansas. Eligible companies may retain 95% of the payroll withholding tax of employees that are determined to be eligible for up to 10 years. Job eligibility depends on location of jobs and median wage compared to the median wage in Pratt County. Eligible jobs are those that pay above the county median wage where the operations and jobs will be located.

A not-for-profit company that qualifies as a headquarters and is approved by the Secretary of Commerce is also eligible for benefits providing all other program criteria is met. PEAK is available for full-time and part-time jobs that work 20 hours or more per week, year-round. (See K.S.A. 74-50, 210 through 74-50,219). In addition, eligible applicants must make available to full-time employees adequate health insurance coverage and pay at least 50 percent of the premium for full-time employees. The Secretary of Commerce is designated to determine the eligibility and approve the benefits of companies qualifying for the PEAK program.

Companies wishing to participate need to contact Pratt Economic Development Staff who will help them work through the process.

HPIP provides tax incentives to employers that pay above-average wages and have a strong commitment to skills development for their workers. For certain non-manufacturing firms, there may be an additional qualifier that a majority of their revenues will need to come from outside of Kansas.

To be eligible for HPIP, a worksite must either pay above-average wages for its industry, or one-and-a-half times the statewide average wage exclusive of owner compensation. To determine whether a worksite pays above-average wages, the worksite’s wages will be compared to those of business establishments in like industries within the county or counties that comprise the appropriate HPIP wage region. Once the wage criterion has been met, the worksite must either invest an amount equal to two percent of its total payroll on qualified employee training or participate in the Kansas Industrial Training (KIT) program or the Kansas Industrial Retraining (KIR) program.

Specific incentives extended to firms meeting the qualifications include the following:

A 10 percent investment tax credit against corporate income tax on qualified business facility investment (as defined by K.S.A. 79-32,154) that exceeds $50,000. The investment tax credit is a one-time credit with a 16-year carry forward provision, subject to re-qualification for any unused credits, and can be used to reduce up to 100 percent of a firm’s annual tax liability.

A workforce training tax credit of up to $50,000 per annum on qualified training expenditures above two percent of reported worksite wages. Unused training tax credit cannot be carried forward for use in future tax years. A sales tax exemption on purchases and services relating to new investment in facility or equipment after HPIP certification is obtained.

As a critical first step in order to take advantage of HPIP tax credits, the firm must submit a Project Description (PD) Form to Commerce, estimating the scope of anticipated investment. The statute requires submittal of the Project Description form before the company commits to move forward with the investment (e.g., by making a purchase, signing a commitment document such as an equipment purchase order or lease agreement or construction contract, or moving assets into Kansas that are already owned by the company at an out-of-state location). Pre-identification of qualified investment on the PD allows the company to potentially earn tax credits on that investment.

Company pays above-average wages, company invests at least 2 percent of payroll in training, business in major NAICS category of (first three numbers) 221,311-339,423-425,481-519,521-721 or 811-928, if business is in major NAICS category of (first three numbers) 221,423-425,481-519,521-721 or 811-928, more than half of sales must be to Kansas manufacturers and/or out-of-state commercial or government customers.

Example Expenses:

Capital investment- $5,000,000 (all expenses in this example go toward equipment)

Number of jobs created- 30 (not required to qualify for HPIP)

Annual Payroll- $1,000,000

Investment in training- $60,000 (may utilize state training programs KIT, KIR)

Year's income tax liability- $75,000

Example Benefits:

Employee Training tax credit- $40,000 (exceeding 2 percent of annual payroll, max $50,000)

Investment Tax Credit- $495,000 (10 percent of amount exceeding $50,000)

Total HPIP Income Tax Credit- $495,000

Less: Total income tax liability during year of investment- $75,000

Income Tax Credits to use toward future Tax liability- $420,000

Sales Tax Project exemption- $307,500 (capital investment X 8.25% Pratt County sales tax)

Total High Performance Incentive Program Benefit:

HPIP Investment Tax Credit- $495,000

Sales Tax Exemption Savings- $307,500

Total HPIP Benefit- $802,500

Companies who qualify for HPIP can also qualify for a state and local sales tax exemption for expenditures made on the materials, equipment and services purchased when building, expanding or renovating a business facility. Companies that qualify for HPIP are eligible to receive a state and local sales tax exemption without being tied to a job creation requirement. The Request for Project Exemption Certificate (PR-70b) needs to be filed prior to making taxable purchases related to the project. The application is filed with the Kansas Department of Revenue. A letter from the Kansas Department of Commerce would need to accompany the sales tax exemption request indicating the legal entity was certified under HPIP for the request to be approved. The sales tax exemption certificate will be issued effective from the latter of the date the exemption request is received by Revenue or the start of the HPIP certification period. The sales tax exemption can be effective for the term of the project if the company remains certified under HPIP.

The KIT and KIR Programs were designed to help support business expansion efforts by supporting training of new or existing employees to avoid job displacement due to inadequate or obsolete skills. A KIT or KIR training grant can reimburse some of the costs associated with training or retraining: instructor salaries, curriculum development, travel, materials, supplies, textbooks, minor training equipment and some facility costs.

Eligible Kansas taxpayers are allowed to claim an expense deduction for business machinery and equipment, placed in service in Kansas during the tax year. Effective Tax Year 2013 and forward, only C-Corporations may claim the expense deduction against corporate income tax liability. The expense deduction will not be available to other types of taxpayers. Effective Tax Year 2014 and forward, privilege taxpayers may claim the expense deduction against the privilege tax liability. Pratt County Economic Development Staff will work with companies to determine the Machinery and Equipment expensing deduction tax law in place at the time of the project.

All merchants’ and manufacturers’ inventories have been exempt from property taxes by constitutional amendment since 1989 (K.S.A. 79-201m).

Businesses using Industrial Revenue Bonds (IRBs) as a financing mechanism may enjoy certain tax exemptions: Property financed with IRBs is exempt from ad valorem taxation for up to 10 years after the bonds are issued. However, localities may elect to negotiate payments in lieu of taxes (K.S.A. 79-201a). The cost of construction labor, building materials and machinery and equipment is exempt from state and local sales taxes if financed by IRBs (K.S.A. 79-3603).

Electricity, gas and water consumed during manufacturing are exempt from the Kansas sales tax [K.S.A. 79-3606(n)]. All sales of manufacturing machinery and equipment are exempt from sales taxes [K.S.A. 79-3606(kk)]. This exemption extends to machinery and equipment purchased primarily for use in the assembly, processing, finishing, storing, warehousing or distribution of tangible personal property intended for resale. Specifically, K.S.A. 79-3606 (fff) provides that the following shall be exempt from tax: all sales of material handling equipment, racking systems and other related machinery and equipment that is used for the handling, movement or storage of tangible personal property in a warehouse or distribution facility in this state; all sales of installation, repair and maintenance services performed on such machinery and equipment; all sales of repair and replacement parts for such machinery and equipment.

Businesses may take advantage of several other items exempt from sales tax which can be found in K.S.A. 79-3606 and 79-3603.

A sales tax exemption certificate must be obtained from the Kansas Department of Revenue prior to any purchases. The exceptions to this involve the labor on residential construction, original construction and replacement or repair of bridges and highways, which does not require a certificate [K.S.A. 79-3603(p)]. The Pratt Economic Development Staff can assist businesses in obtaining exemption certificates.

In order to stimulate increased research and development activity by Kansas businesses, the State offers an income tax credit equal to 6.5 percent of a company’s investment in research and development above an average of the actual expenditures in research and development activities made in the taxable year and the two immediate preceding taxable years. Only 25 percent of the allowable annual credit may be claimed in any one year. Any remaining credit may be carried forward in 25 percent increments until exhausted. Expenditures in research and development activities are defined by Kansas law as those expenses that are allowable as deductions under the federal Internal Revenue Code. Beginning in tax year 2013, this credit is only available to corporations subject to the Kansas corporate income tax, i.e. C Corporations. This credit shall not be available to individuals, partnerships, S Corporations, limited liability companies or other pass through entities (Schedule K-53, K.S.A. 79-32,182b). The research and development tax credit will not be available for Individuals, Partnerships, S-Corps, LLCs and other pass-through effective tax year 2013.

Any taxpayer who spends money to make all or any portion of an existing building or facility accessible to persons with a disability is entitled to a tax credit. The building or facility must be on real property located in Kansas and used in a trade, business or for the production of income. The tax credit available is equal to 50 percent of expenditures of this kind, or $10,000, whichever is less. The tax credit is applied against the income tax, premium tax or privilege fees and shall be deducted from the taxpayer’s tax liability in the taxable year in which the expenditures are made. This tax credit may be carried over for a period of four years after the year the credit was earned. Effective tax year 2013, this credit shall only be available to corporations subject to the Kansas corporate income tax, i.e. C Corporations. Effective tax year 2014 and forward, the credit becomes available to all taxpayers. (Schedule K-37, K.S.A. 79-32,177, K.S.A. 79-1117 and K.S.A. 40-2813).

Tax credits may also be offered against Kansas income tax liability for businesses providing child day care services to employees, for corporations that invest in the Kansas Entrepreneurs, and angle investor tax credits. For more information contact Pratt County economic development staff. , can claim a state tax credit of 75 percent of the amount donated. The minimum investment to claim the tax credit is $250, and the tax credit is limited to a total of $2 million for any fiscal year.

NetWork Kansas serves as a link between business owners and resources available through state government and provides a central point of contact to streamline the business startup process. A NetWork Kansas referral coordinator will connect you with resources within the state that are involved in all aspects of starting a business, including legal structure, employment, taxes, licensing and some federal requirements.

Assistance is provided to Kansas companies wishing to begin or expand their international marketing efforts. Pratt Economic Development staff will connect companies with State staff members who counsel individual Kansas firms, provide export data and foreign market research, coordinate with domestic and foreign agencies in marketing promotions, conduct export seminars, recruit and assist company participation in international trade shows, host foreign delegations, distribute foreign trade leads to appropriate Kansas companies and assist in locating export financing packages that fit your company’s needs.

The Kansas International Trade Show Assistance Program assists Kansas producers who want to exhibit at international trade shows. The program can help reimburse successful applicants for up to half of their direct exhibition-related expenses, not to exceed $3,500 per international show. Pratt Economic Development staff will assist companies interested in this opportunity.